Texas Lege Tracker

On this page, we’ll be keeping a list of bills we’re monitoring throughout the 89th Texas Legislative Session from January to May 2025. You can find general information on each bill and the Dallas Housing Coalition’s analysis of each bill below. Click here for the Dallas Housing Coalition’s 89th Texas Legislative Session Agenda. Click on a bill to be taken to its Texas Legislature Online’s webpage.

How to navigate the legislative process:

Note: These are external links. We are sharing these for informational purposes about the legislative process only. The Dallas Housing Coalition does not endorse any information or positions that may be found on these pages.

Texas Legislature Online (TLO) – Official source of up-to-date information on bills, hearings, and other aspects of the legislative process

How to navigate TLO (Parts 1, 2, 3, 4), by Representative Gina Hinojosa

Who represents me?, Texas Legislature Online – How to identify your elected officials

Legislative process

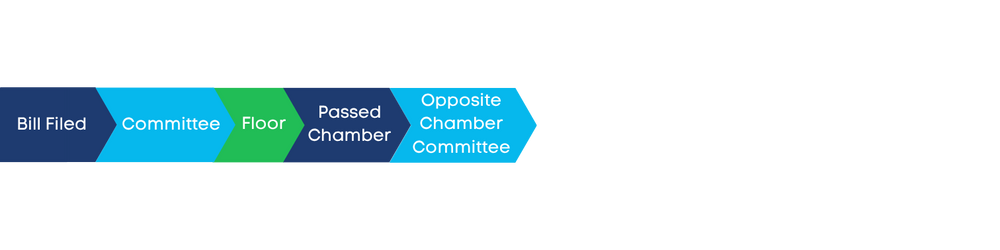

Short version (visualization), the Texas Politics Project, University of Texas

Long version (document), Texas Legislative Council

Narrative version (FAQ), Texas Tribune

Important dates, Texas Legislative Council

Check back often throughout session for updates and new resources. Please address any inquiries to Bryan Tony, Executive Director, at bryan@dallashousingcoalition.com.

How do Texans feel about many of the housing reforms currently being proposed?

A new survey conducted by Dallas Housing Coalition member, Texans for Housing in partnership with YouGov, reveals that Texans across the state are increasingly dissatisfied with housing availability and affordability. The survey, fielded from March 11 to March 19, 2025, gathered responses from 801 registered voters in Texas to gauge their views on the state of the housing market and support for new policies, including the proposed Texas Starter Homes Act. The results demonstrate broad, bipartisan support for key reforms aimed at addressing the housing crisis.

Read our April 16, 2025 press release announcing the survey’s findings.

Key Findings:

Housing reforms are widely supported: Large majorities of Texas voters support key measures in the Texas Starter Homes Act, which seeks to allow more homes to be built in the state by relaxing restrictive local rules. Support includes allowing smaller single-family homes, smaller lots and yards, and eliminating mandatory homeowners’ association (HOA) amenity requirements.

There is strong demand for policy changes: 61 percent of Texas voters support the Texas Starter Homes Act overall, with majorities across political affiliations. Support includes 70 percent of Democrats, 58 percent of Republicans, and a 43-27 margin among Independents, with the rest undecided.

Housing is a top priority: When asked to identify their most pressing issues, 28 percent of Texans cited the cost of housing, ranking it among the top three statewide concerns behind inflation and immigration. Notably, housing is the top issue for Independent voters, surpassing immigration and job availability.

Individual property rights won out over local government restrictions: A majority (62 percent) of voters believe that property owners should have flexibility to build diverse housing types on their land, rather than granting local governments the power to restrict development. This includes majorities across the state’s rural, suburban, and urban areas.

89th Texas Legislative Session

In Support

Eckhardt - Proposing to adopt an exemption from ad valorem taxation, enabling lege for SB 634

Bettencourt - Relating to size and density requirements for residential lots in certain municipalities

Sen. Royce West - Workforce housing revolving loan fund for single-family, affordable housing

Sen. Royce West - Expedited permitting for LIHTC in larger cities

Johnson - Relating to the establishment of the workforce housing program by the TDHCA

Eckhardt - Relating to the establishment and implementation by the TDHCA of the Texas Tenant Readiness and Landlord Incentive Pilot Program

Sen. Royce West - Requires cities to publicly announce city-owned land available for workforce housing development

Sen. Royce West - Amending the Uniform Partition of Heirs’ Property Act

Zaffirini - Relating to the accrual of interest on overdue child support

Eckhardt - Proposing to adopt an exemption from ad valorem taxation, enabling lege for SJR 30

West - Provides refunds on sales and use taxes paid on building materials used in subsidized housing projects

Hughes - Legalize ADUs statewide

Flores - Relating to the regulation of new HUD-code manufactured housing

Cook - Relating to the disclosure of certain fees by a landlord

Zaffirini - Relating to the accrual of interest on overdue child support.

Hughes - Allow residential development in commercially zoned and mixed-use districts and encourage office-to-residential conversion

Hughes - Relating to procedures for changes to a zoning regulation or district boundary

Middleton - Relating to municipal regulation of multifamily and mixed-use development on religious land

Blanco - Relating to the allocation of low income housing tax credits

Johnson - Relating to the confidentiality of residential eviction case information

Johnson - N. Johnson mezzanine fund

Hancock - Relating to the regulation of manufactured homes

N. Johnson - Would create a pathway for municipalities to allow single-stair apartments

Bucy - Proposing a constitutional amendment authorizing the use of money in the state highway fund for transit-oriented projects

Jones, Venton - Proposing to adopt an exemption from ad valorem taxation, enabling lege for HB 1367

Harris - Allow third-party review of plats and property development plans, permits, and similar documents, and the inspection of an improvement related to such a document.

Bernal - Exempt LIHTC projects from residents and force a supermajority to approve zoning change

Lopez, Ray - Relating to the collection and publication of affordable housing information by certain municipalities and the Texas Department of Housing and Community Affairs

Rosenthal - Repeal income discrimination ordinances

Bucy - Relating to the use of certain money transferred to and deposited in the state highway fund

Bucy - Extend notice to vacate to 14 days

Walle - Relating to the establishment and implementation by the Texas Department of Housing and Community Affairs of the Texas Tenant Readiness and Landlord Incentive Pilot Program.

Toth - Require cities to grant/deny building permits within 30 days or provide applicant with timeline for approval

Toth - Building permit application turnaround

Gonzalez, Jessica - Relating to the disclosure of certain fees by a landlord

Jones, Venton - Proposing to adopt an exemption from ad valorem taxation, enabling lege for HJR 96

Jones, Venton - Eviction sealing when tenant wins case

Collier - Allow tenants an opportunity to cure

Hickland - Protesting changes to municipal zoning regulations and boundaries

Bucy- Legalize ADUs statewide

Goodwin- Relating to the establishment of workforce housing program by the TDHCA

Bucy- Relating to the establishment of the housing Texas fund to be administered by the TDHCA

Meza- Relating to a tenant's right to terminate a residential lease following certain outages of essential utilities

Collier - Relating to the confidentiality of eviction case information.

Talarico - Relating to municipal and county regulation of accessory dwelling units; authorizing fees

Bowers - Relating to the regulation of certain eviction-related service businesses

McQueeney - See SB 1341 (Hancock) for identical companion bill relating to the regulation of manufactured homes.

Gates - See SB 15 (Bettencourt) for identical companion bill relating to size and density requirements for residential lots in certain municipalities.

Monitoring

Gates - See SB 867 (Bettencourt) for identical companion bill

Vasut - Eliminate property taxes and require a study of alternative methods of taxation

Goodwin - Limits property tax increases of single-family homes if they are leased for less than 85% fair market value

Bell, Keith - Dedicate part of budget surplus to tax relief

Cain - Dedicate part of budget surplus to tax relief through reducing school M&O taxes

Lopez - Relating to the collection and publication of affordable housing information

Meza - Require TAMU to maintain a list of corporate-owned SF properties

Morales - Require all LIHTC projects to be within two miles of a grocery store

Vasut - Prevent cities from prohibiting ADUs on SF or duplex lots

Metcalf - Extend cap on property taxes to commercial

Barry - Extend cap on property tax to commercial

Garcia, Josey - Relating to the creation of a specialty court for individuals who commit family violence; imposing fees for participation

Shaheen - See SB 1557 (Paxton) for the identical companion bill

Menéndez - Relating to regulations adopted by entities for the construction of residential or commercial buildings

Paxton - Relating to the powers or regional transportation authorities (DART)

Oppose

Highlighted bills indicate those that were our highest priority to advocate for.

Button - Relating to the eviction from real property of certain persons not entitled to enter, occupy, or remain in possession of the premises.

Swanson - Give State Representatives veto power to stop approved LIHTC projects from being built in their districts

Tepper - Prevent “adopt or enforce” ordinance or zoning variance to allow more than one dwelling on a lot

Pierson - Related to the unauthorized entry, occupancy, sale, rental, etc

Bettencourt - Relating to the authority of home-rule municipalities to regulate the occupancy of dwelling units

Bettencourt - Relating to certain municipal regulation of conversion of certain office buildings to mixed-use and multifamily residential occupancy